A General Ledger Can Be Best Described as a

A general ledger is a master accounting document that includes a businesss past credit and debit transactions and serves as the foundation of the double-entry accounting system. The general ledger tracks all your financial transactions When I first started working in accounting the general ledger was a huge physical book.

General Ledger Gl Overview What It Records Effects Of Blockchain

Gain loss assets liabilities equities revenue and expenses.

. Its primary function is to collect and organize data from the following sources. The general ledger can be described as. More than one of the above.

A general ledger is simply a master document containing all of a companys transactions neatly categorized. A general ledger is known to be a document that is said to be the record-keeping system used by a companys financial data. A general ledger is a record of all of a companys and its subsidiaries assets liabilities expenses income and equities.

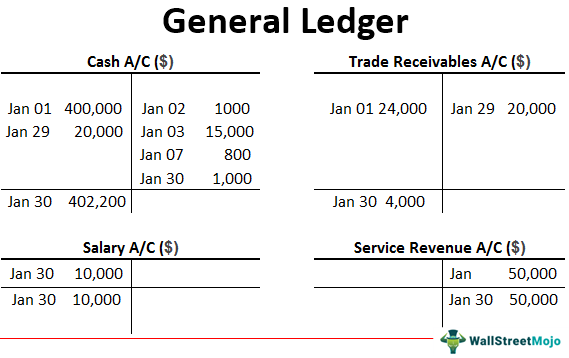

A general ledger is the master set of accounts that summarize all transactions occurring within an entity. A General Ledger Can Best Described as a Get link. The income statement the balance sheet and the cash flow statement.

General issues throughout entire general ledger and reporting cycle. The general ledger matters because financial statements matter. A general ledger keeps a detailed record of every transaction in the life of a company.

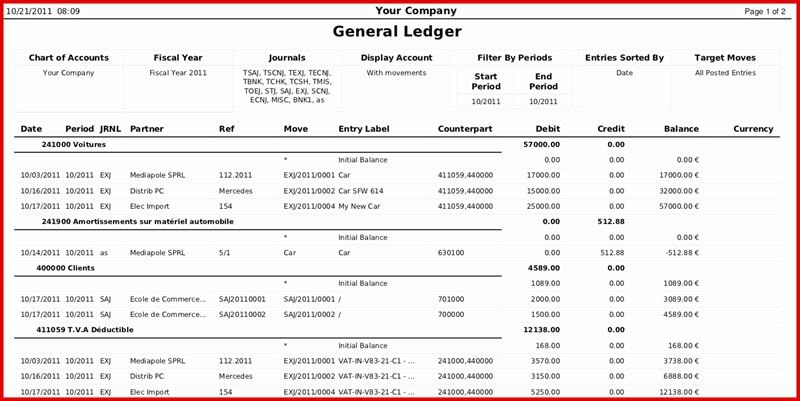

Either individual transactions or summary-level postings from subsidiary-level ledgers are listed within each account number sorted by. O The general ledger describes all liability accounts. 13 Review of all changes to general ledger data.

There may be a subsidiary set of ledgers that summarize into the general ledger. So General Ledger contains information related to different accounts. A general ledger is the foundation of a double-entry accounting system.

-Each of the accounting cycle subsystems described in Chapters 14 through 17 provides information about regular transactions. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. One of the basic financial statements of an organization A record on which are recorded the increases and decreases of a particular financial statement component such as cash A list of account titles and balances at a certain date A grouping of the accounts used by an organization to prepare its basic financial statements.

11 Data processing integrity controls. There are three core types of financial statements useful to small business owners. Loss or destruction of data.

Think of the general ledger as the main database of a companys financial records and information with other financial documents being derived from the information recorded in the general ledger. O The general ledger is a record of all transactions in alphabetical order O The general ledger is a. A General Ledger is a Ledger that contains all the ledger accounts other than sales and purchases accounts.

Other Apps - April 10 2022 Features Of General Ledger Accounting General Ledger In Accounting Meaning Examples General Ledger Accounts Office Of The Washington State Auditor General Ledger Accounting Double Entry Bookkeeping a as Can General. It contains the record of all the financial transactions taking place in a business. This can be done automatically with accounting.

Updated May 02 2022 3 min read. General Ledger GL accounts contain all debit and credit transactions Credit Sales Credit sales refer to a sale in which the amount owed will be paid at a later date. A general ledger is the record-keeping system for a companys financial data with debit and credit account records validated by a trial balance.

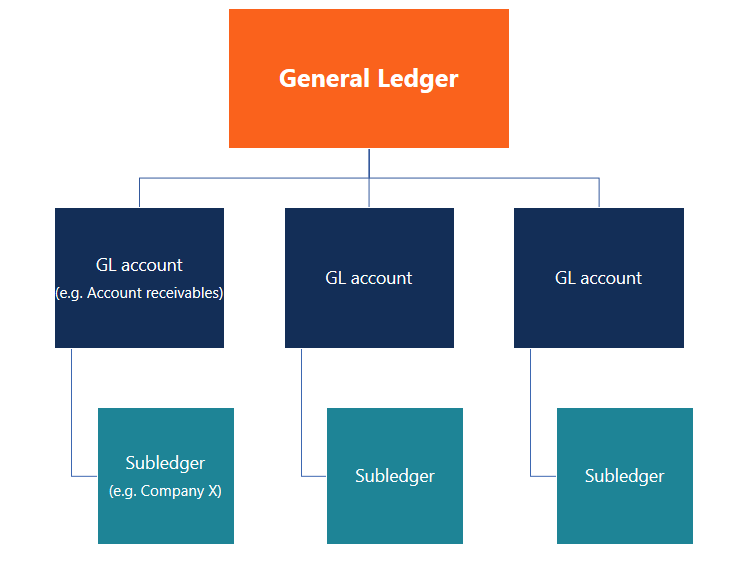

General ledgers are generally broken down into records of accounts and account balances and financial transactions and from there if necessary into subledgers. They draw on data compiled in the general ledger. Inaccurate or invalid general ledger data.

Before bookkeeping was done with software or cloud solutions we would manually record transactions in smaller books total key numbers and then transfer those amounts to a. O The general ledger combines sales and expenses to determine the net income of a business. General ledgers transactions are entered as either a debit or a credit.

A general ledger provides information to produce other financial reports. It has a debit and credit account records. The general ledger can be described as.

The basic sequence in the accounting process can best be described as. One of the basic financial statements of an organization A record on which are recorded the increases and decreases of a particular financial statement component such as cash A list of account titles and balances at a certain date A grouping of the accounts used by an organization to prepare its basic financial. The general ledger is important for assessing a companys financial performance.

General ledgers list transactions under seven categories. It is known to help one to have a record of each financial transaction that occurs during the operations of an operating firm. The general ledger contains all of the accounts currently being used in a chart of accounts and is sorted by account number.

Therefore you need to prepare various sub-ledgers providing the requisite details to prepare a single ledger termed as General Ledger. These transactions are organized by account like assets liabilities expenses and revenue. How many categories and subledgers are used depends.

You need it to file your taxes. The general ledger and reporting system plays a central role in a companys accounting information system. Lets see how it works and how it can work for your business.

The general ledger is a vast historical data archive of your companys financial activities including revenue expenses adjustments account balances and often much more. General ledgers transactions are entered as either a debit or a credit. A general ledger is the record-keeping system for a companys financial data with debit and credit account records validated by a trial balance.

General ledger refers to the primary accounting record that is maintained by a company which is based on the double entry bookkeeping system. The general ledger details all financial transactions of all accounts so as to accurately account for and forecast the companys financial health. General ledger forms the basis of financial reporting and associated information.

What is General Ledger. 12 Restriction of access to general ledger. In accounting Accounting a General Ledger GL is a record of all past transactions of a company organized by accounts.

This is where bookkeeping gets its name. The general ledger in turn is used to aggregate information into the financial statements of a business.

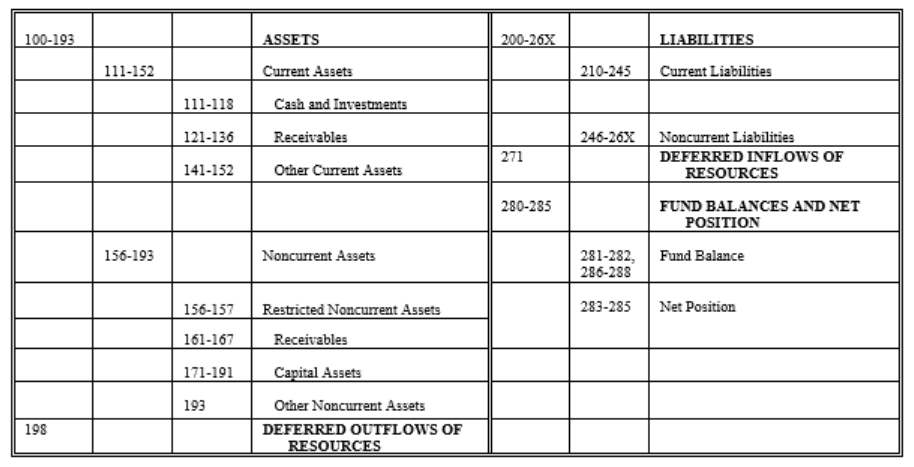

General Ledger Accounts Office Of The Washington State Auditor

General Ledger In Accounting Meaning Examples

No comments for "A General Ledger Can Be Best Described as a"

Post a Comment